Richland included in incentive program

Part of Richland Parish is included in a census tract which is among 150 the U.S. Department of the Treasury has certified as Opportunity Zones, which will feature tax incentives to attract investments to low-income communities in the state.

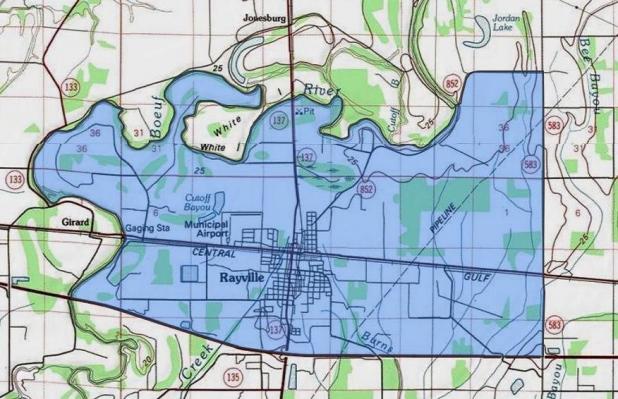

The section of Richland Parish included in the program is in the Rayville area, north of I-20 between Girard and Bee Bayou roads.

Part of the federal Tax Cuts and Jobs Act of 2017, the Opportunity Zones program will establish low-income communities as tax-advantaged areas for new long-term private investment.

The Treasury Department administers the program through its Community Development Financial Institutions Fund, or CDFI Fund.

That office sought nominations from Louisiana, with the state including a public comment period in March and soliciting statewide input to identify census tracts with the greatest need and the most potential for new investment, development and job creation. With input from a broad range of stakeholders, Gov. Edwards nominated Louisiana census tracts in April.

“We’re pleased that all 150 census tracts we nominated are now qualified as Opportunity Zones,” Gov. John Bel Edwards said. “This federal certification means we have new tools at our disposal to bring much-needed investment and new jobs to the areas of Louisiana who most need them. Through a collaboration of private investors, state agencies and local communities, we can work hand-in-hand to ensure that new opportunities for growth are created in Louisiana through this program.”

With public input, Gov. Edwards nominated the maximum 25 percent of Louisiana’s low-income census tracts for the Opportunity Zones program. The Treasury Department will issue additional guidance about how investors may qualify for the program through equity investments in the selected Opportunity Zones.

The public may view Louisiana’s Opportunity Zones on an interactive map.

Visit OpportunityLouisiana.com/business-incentives/opportunity-zones for an interactive map of the Opportunity Zones (clicking on the State of Louisiana icon in the circle will lead viewers to information about each zone and the political jurisdictions in which they are located).

Congress and the Treasury Department advised governors to consider lower-income areas where existing state, local and private economic development initiatives are underway to attract new investment and to foster startup activity.

The zones can include previously designated Empowerment Zones, Renewal Communities, or New Markets Tax Credits project areas that help attract investment to under-served areas.

For investors, the primary attraction of Opportunity Zones is deferring and lowering federal taxes on capital gains.

For a qualified Opportunity Zones investment, capital gains taxes may be deferred the first five years; after Year 5, taxes may be cancelled on 10 percent of the original capital gains investment and deferred for the remaining capital gains; in Year 7 through Year 10, taxes may be cancelled on 15 percent of the original capital gains investment, and the remainder may be deferred through 2026; for Opportunity Zones investments lasting longer than 10 years, investors are exempt from capital gains taxes on the Opportunity Zones investment itself, in addition to the other benefits for capital gains carried into the investment.